irs.gov direct pay

Note that your tax payment. Find Out Today If You Qualify.

Hammernik Associates If You Are A Taxpayer That Pays Estimated Taxes The 2nd Quarter Estimated Tax Payments For 2021 Are Due Today 6 15 21 Irs Estimated Tax Payments Can Be Paid

Social secuirty number primarys if jointly filed Tax year s Tax form or notice number eg Form 1040 Mail the payment as follows.

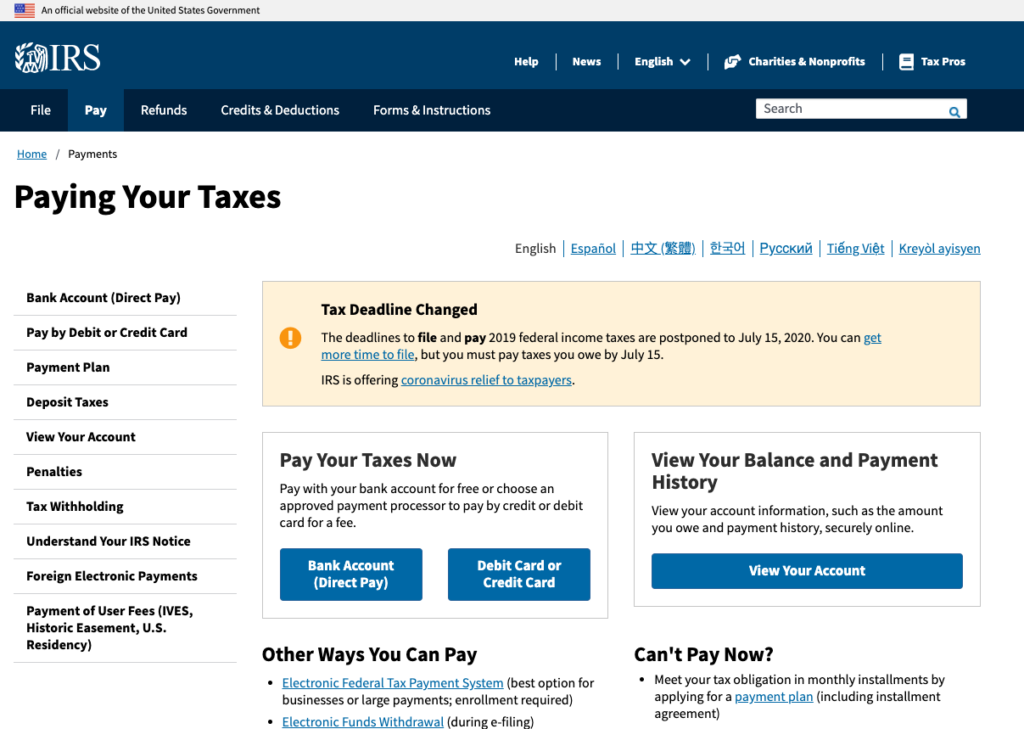

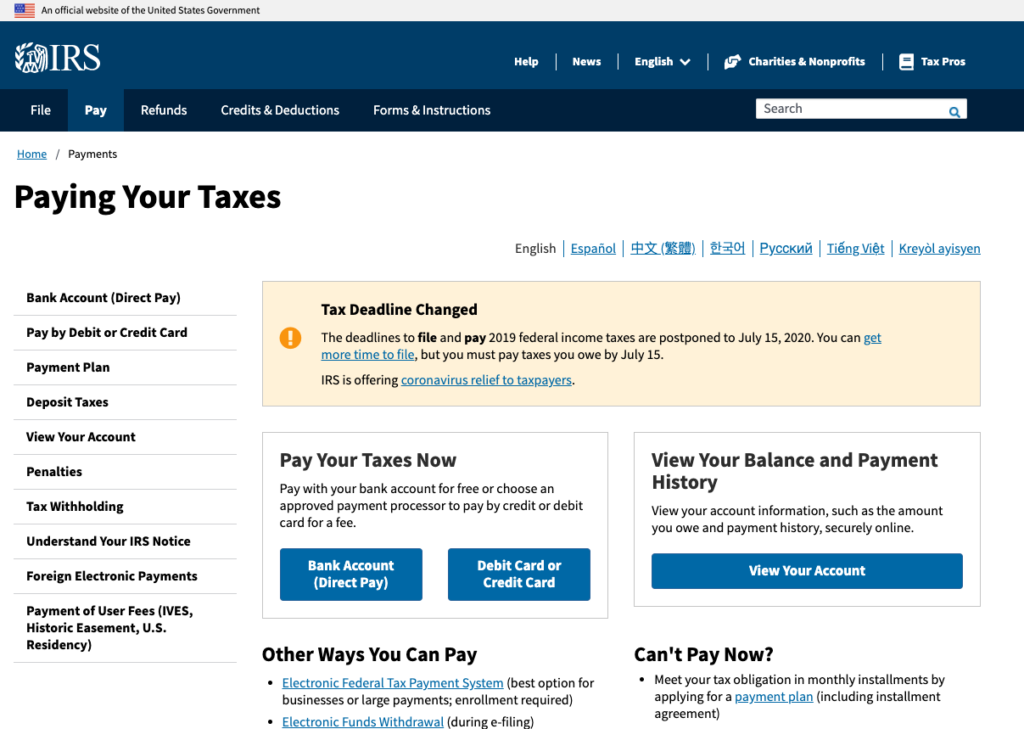

. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. IRS Direct Pay is a web-based system available on the IRS website wwwirsgov. See What You Owe and Pay by Bank Account.

I like to pay my federal taxes with credit card but I dont see a option Charge my credit card Available options I see --Direct debit from my bank account. IRS Direct Pay wont accept more than two payments within a 24-hour period and each payment must be less than 10 million. IRS Direct Pay only accepts individual tax payments.

Direct Pay del IRS no acepta más de dos pagos dentro de un período de 24 horas y cada pago debe ser menor de 10 millones. Ad Use our tax forgiveness calculator to estimate potential relief available. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

With an online tool from the IRS you can track your stimulus check find out how youre being paid and if you want update your bank direct deposit information to get your. Please try again later. IRS Direct Pay will continue to make content accessible for users using assistive technology in an effort to serve the needs of all who visit our application.

Ad Do You Have IRS Debt Need An IRS Payment Plan. Its secure free of. Click here for more information.

Your name and address. Find Out Today If You Qualify. You have reached the maximum number of allowable payments.

It is a free IRS service that lets you make tax payments online directly from your bank account to the IRS. With IRS Direct Pay. You cannot schedule multiple or recurring.

Let your clients know they can now pay their tax bills directly from their checking or savings accounts using IRS Direct Pay. Note If you have made a payment through Direct Pay you can use this feature to view your payment details and status. Information Collected and Stored Automatically.

Ad Use our tax forgiveness calculator to estimate potential relief available. For users who are blind or who have. IRS Direct Pay doesnt collect personal information when you visit our website unless you choose to provide that information.

You can modify or cancel your payment until 1145 PM. Para pagos electrónicos mayores utilice el Sistema de Pago. For more information please visit the Direct Pay.

From Your Bank Account Using EFTPSgov. Log in to view the amount you owe your payment plan details payment history and any scheduled or. You can schedule payments up to 365 days in advance for any tax due to the IRS when you register with the Electronic Tax Federal.

Schedule payments in advance IRS Direct pay allows taxpayers to schedule payments up to 30 days in advance. The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. For larger electronic payments use EFTPS or.

This website is experiencing technical difficulties. When you visit the. Acceptable Use and Privacy Policy.

Ad Do You Have IRS Debt Need An IRS Payment Plan. - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit. IRS Direct Pay Now Available on IRSgov.

You can visit Make a Payment page for alternative payment methods or come back later and try again. Extension Make a full or partial payment on your taxes in order to receive an extension without filing Form 4868 Application for Automatic.

Irs Direct Pay Option Not Working On Tax Day Youtube

Payments Internal Revenue Service

Www Irs Gov Directpay How To Make An Online Irs Payment

Does Irs Direct Pay Use Bank Of America Or Is This A Scam Personal Finance Money Stack Exchange

Irs Payment Options How To Make Your Payments

Direct Pay Help Internal Revenue Service

Get Your Refund Faster Tell Irs To Direct Deposit Your Refund To One Two Or Three Accounts Internal Revenue Service

0 Response to "irs.gov direct pay"

Post a Comment